Cryptocurrencies are digital virtual currencies that are meant to function as exchange mediums. You can use them to purchase goods and pay for flights, hotel rooms, and even for tuition. You can also use them to invest. In fact, cryptocurrencies are considered to be the hottest investment opportunity today. Then again, you should take note that they are high-risk investments because they are partly unregulated and their market value tremendously fluctuates.

Unlike other currencies, cryptocurrencies use decentralized control instead of central banking and electronic money systems. Their decentralized control works through blockchains, which are public transaction databases, and function as distribution ledgers.

At present, the most commonly used cryptocurrencies are Bitcoin, Ethereum, Ripple, Bitcoin Cash, NEM, Litecoin, IOTA, NEO, Dash, Qtum, and Monero. The most popular among these cryptocurrencies is Bitcoin. It is also more volatile than the others. Thus, it is an excellent choice for arbitrage.

So, what is cryptocurrency arbitrage?

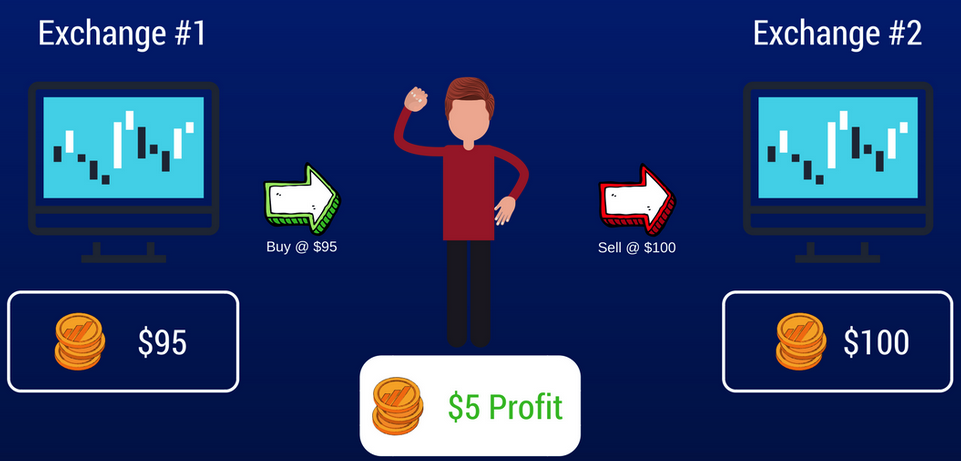

Arbitrage refers to the practice of using price differences in markets to your advantage. Such price differences occur because some exchanges tend to be more liquid than the others. A bigger exchange with more trading volume can control the price of the entire market. A smaller exchange with a small lag will then follow. This small lag causes the arbitrage.

For example, Bitcoin deposits become untaxed. This is really great because more people can now purchase Bitcoins. As they flock towards the common exchanges to make a trade, the price of Bitcoins increases. Say, these people chose Bitstamp. The more buyers there are, the higher the price of Bitcoin becomes. Then again, the volume of other exchanges, such as CampBX, will noticeably be lesser and their market will be slow to react to the change. Within one hour, the price of Bitcoin at CampBX will be lesser than that in Bitstamp. For instance, you can purchase Bitcoin for $101 at CampBX and then sell it for $105 at Bitstamp. This gives you an arbitrage of $4.50.

If you can deal with the complexities, you can make decent profits. You can even use a cryptocurrency arbitrage website to help you make the most of your crypto arbitrage opportunities. There are plenty of markets for cryptocurrencies. Any given coin or asset can be offered at a different price across these markets. Through arbitrage websites, you can find out how much a currency is offered in a certain market, as well as how much you can sell it in another.

Anyway, what are these complexities involved with cryptocurrencies?

One of them is blockchain confirmation. A lot of people get confused with the delay between the exchanges that occur upon transfers. Blockchain confirmation refers to the process that is essential in Bitcoin exchange. It takes about ten minutes to finish.

Exchanges typically require six confirmations before newly transferred funds can be used. So, if you are executing an arbitrage, you may have to wait for one hour before you can sell your cryptocurrency in another market.

But what if one hour is too long to take advantage of any arbitrage? It is true that an additional hour may eliminate the available arbitrage. Nevertheless, you can still get around such limitation. You can keep a small balance of your cryptocurrency during a large exchange. If you do this, you can benefit from an immediate arbitrage.

For example, if you are trading a 0.1 Bitcoin, you should keep 0.1 or more Bitcoin during a more expensive exchange. This 0.1 Bitcoin will eventually go from a cheap exchange to an expensive exchange in one hour. If you wish to execute more than one arbitrage per hour, you should keep more funds for larger exchanges.

Fees are also regarded as complexities. You have to consider the transaction fees involved when you execute an arbitrage. Exchanges usually have a 0.6% transaction fee. Take note that this fee is taken twice because it occurs for every exchange.

When you calculate your profit, see to it that you consider the fees involved. Aside from the transaction fees, you also have to consider the flat deposit fees and flat withdrawal fees.

How to Execute an Arbitrage

First, you need to search for a good opportunity. Look for exchanges, and compare asks and bids. See if you can spot a negative spread. Basically, a spread refers to the difference between asks and bids. A positive spread occurs when the lowest ask of the exchange is higher than the best bid.

Next, you have to execute the trade. Once you find a great exchange opportunity, you can start trading. Make sure that you have sufficient funding and you are careful when placing orders.

Finally, you have to rebalance your accounts. Most traders only trade once per day. This is okay since you can trade again the next day. Just make sure that your balances are even.

Arbitrage brings exchanges to an average price. As the cryptocurrency markets grow and the rate at which traders execute arbitrage increases, the gap between exchanges becomes narrow.

Anyone can take advantage of cryptocurrency arbitrage. You can succeed in this venture even though you are not a high frequency trader or a hedge fund trader. You can have better luck if you have good programming skills since there are plenty of open source arbitrage libraries you can use.

Comments (No)